McDermott International, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to |

McDermott International, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| McDermott International, Inc. | |

David Dickson | 757 N. Eldridge Pkwy. | |||

President and Chief Executive Officer | Houston, Texas 77079 | |||

March 30, 201224, 2014

Dear Stockholder:

You are cordially invited to attend this year’s Annual Meeting of Stockholders of McDermott International, Inc., which will be held on Thursday,Tuesday, May 10, 2012,6, 2014, at 757 N. Eldridge Parkway,The Westin Houston Hotel, 945 Gessner Road, Houston, Texas 77079, on the 14th floor,77024, commencing at 10:00 a.m., local time. The notice of Annual Meeting and proxy statement following this letter describe the matters to be acted on at the meeting.

McDermott is utilizing the Securities and Exchange Commission’s Notice and Access proxy rule, which allows companies to furnish proxy materials via the Internet as an alternative to the traditional approach of mailing a printed set to each stockholder. In accordance with these rules, we have sent a Notice of Internet Availability of Proxy Materials to all stockholders who have not previously elected to receive a printed set of proxy materials. The Notice contains instructions on how to access our 20122014 Proxy Statement and Annual Report to Stockholders, as well as how to vote either online, by telephone or in person at the 20122014 Annual Meeting.

It is very important that your shares are represented and voted at the Annual Meeting. Please vote your shares by Internet or telephone, or, if you received a printed set of materials by mail, by returning the accompanying proxy card, as soon as possible to ensure that your shares are voted at the meeting. Further instructions on how to vote your shares can be found in our Proxy Statement.

Thank you for your support of our company.

Sincerely yours,

STEPHEN M. JOHNSONDAVID DICKSON

YOUR VOTE IS IMPORTANT.

Whether or not you plan to attend the meeting, please take a few minutes now to vote your shares.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to beBe Held on May 10, 2012.6, 2014.

The proxy statement and annual report are available on the Internet at www.proxyvote.com.

The following information applicable to the Annual Meeting may be found in the proxy statement and accompanying proxy card:

The date, time and location of the meeting;

A list of the matters intended to be acted on and our recommendations regarding those matters;

Any control/identification numbers that you need to access your proxy card; and

Information about attending the meeting and voting in person.

McDERMOTT INTERNATIONAL, INC.

757 N. Eldridge Pkwy.

Houston, Texas 77079

NOTICENOTICE OF 2012 ANNUAL MEETING 2014 ANNUAL MEETING OF STOCKHOLDERS STOCKHOLDERS

Time and | 10:00 a.m., local time, on |

The Westin Houston Hotel |

945 Gessner Road |

Houston, Texas 77024 |

|

Items of Business | 1. | To elect eight members to our Board of Directors, each for a term of one year. |

| 2. | To conduct an advisory vote to approve named executive officer compensation. |

| 3. | To approve our 2014 Long-Term Incentive Plan. |

| 4. | To ratify our Audit Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, |

To transact such other business that properly comes before the meeting or any adjournment thereof. |

Record Date | You are entitled to vote if you were a stockholder of record at the close of business on March |

Notice and Access | Instead of mailing a printed copy of our proxy materials, including our Annual Report, to each stockholder of record, we are providing access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all stockholders. Accordingly, on March |

Proxy Voting | Your vote is important. Please vote your proxy promptly so your shares can be represented, even if you plan to attend the Annual Meeting. You can vote by Internet, by telephone, or by requesting a printed copy of the proxy materials and using the proxy card enclosed with the printed materials. |

Admission to the Meeting | Attendance at the meeting is limited to stockholders and beneficial owners as of the record date or duly appointed proxies. No guests will be admitted, except for guests invited by McDermott. Registration will begin at 9:00 a.m., and the meeting will begin promptly at 10:00 a.m. If your shares are held in “street name” through a broker, bank, trustee or other nominee, you are a beneficial owner, and beneficial owners will need to show proof of beneficial ownership, such as a copy of a brokerage account statement, reflecting stock ownership as of the record date in order to be admitted to the meeting. If you are a proxy holder for a stockholder, you will need to bring a validly executed proxy naming you as the proxy holder, together with proof of record ownership of the stockholder naming you as proxy holder. Please note that you may be asked to present valid photo identification, such as a valid driver’s license or passport, when you check in for registration. |

By Order of the Board of Directors,

LIANE K. HINRICHS

Secretary

March 30, 201224, 2014

PROXY STATEMENTPROXY STATEMENT FOR 2012 ANNUAL MEETING

2014 ANNUAL MEETING OF STOCKHOLDERS STOCKHOLDERS

TABLETABLE OF CONTENTS CONTENTS

| Page | ||||

| i | ||||

Questions and Answers about the Annual Meeting of Stockholders and Voting | 1 | |||

| ||||

| 7 | ||||

| 11 | ||||

| ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 23 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 30 | ||||

| 35 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| 50 | |||

| 51 | |||

Advisory Vote to Approve | ||||

| 59 | ||||

| 70 | ||||

| ||||

| 73 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

Appendix A — 2014 McDermott International, Inc. Long-Term Incentive Plan | A-1 | |||

QUESTIONSAND ANSWERSABOUTTHE ANNUAL MEETINGOF STOCKHOLDERSAND VOTINGPROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully. As used in this proxy statement, unless the context otherwise indicates or requires, references to “McDermott,” “we,” “us,” and “our” mean McDermott International, Inc. and its consolidated subsidiaries.

Annual Meeting of Stockholders

• Time and Date: | 10:00 a.m., Central Time, May 6, 2014 | |

• Place: | The Westin Houston Hotel 945 Gessner Road Houston, Texas 77024 | |

• Record Date: | March 7, 2014 | |

• Voting: | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. |

Items of Business for the Annual Meeting

| Item of Business | Board Vote Recommendation | Page Reference | ||

Election of directors | FOR Each Director Nominee | 6 | ||

Advisory vote to approve named executive officer compensation | FOR | 56 | ||

Approval of the 2014 McDermott International, Inc. Long-Term Incentive Plan (“2014 LTIP”) | FOR | 59 | ||

Ratification of Deloitte & Touche LLP as auditor for 2014 | FOR | 70 | ||

Your vote is important. Please vote your proxy promptly so your shares can be represented, even if you plan to attend the Annual Meeting. Stockholders of record can vote by Internet, by telephone, or by requesting a printed copy of the proxy materials and using the proxy card enclosed with the printed materials.

Election of Directors — Item 1

The Board of Directors has nominated eight candidates, each for a one-year term. Our Board of Directors recommends that stockholders vote “For” each of the nominees named below.

| Name | Age | Director Since | Independent | Committee Memberships | ||||||||||||||||

| Audit | Compensation | Finance | Governance | |||||||||||||||||

John F. Bookout, III | 60 | 2006 | X | X | X | |||||||||||||||

Roger A. Brown | 69 | 2005 | X | X | Chairman | |||||||||||||||

David Dickson | 46 | 2013 | ||||||||||||||||||

Stephen G. Hanks | 63 | 2009 | X | X | X | |||||||||||||||

Gary P. Luquette | 58 | 2013 | X | X | X | |||||||||||||||

William H. Schumann, III | 63 | 2012 | X | X | X | |||||||||||||||

Mary L. Shafer-Malicki | 53 | 2011 | X | Chairman | X | |||||||||||||||

David A. Trice | 66 | 2009 | X | Chairman | X | |||||||||||||||

i

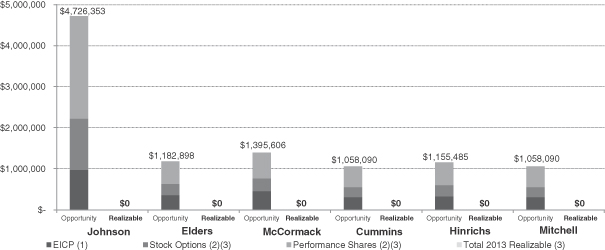

2013 Compensation Program and Realizable Value of Performance-Based Awards

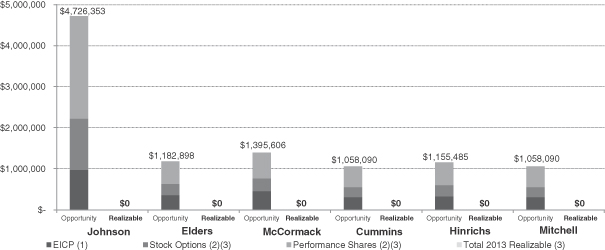

McDermott’s compensation programs are designed to develop, attract, retain and motivate qualified employees to create, expand and execute sound business opportunities for our company. The Compensation Committee is committed to targeting reasonable and competitive total direct compensation for our named executive officers (our “NEOs”), with a significant portion of that compensation being performance-based. Reflecting the Compensation Committee’s philosophy, compensation arrangements in 2013 provided for:

Three elements of target total direct compensation — annual base salary, annual incentive and long-term incentives;

NEO target total direct compensation, on average, being comprised 64% of performance-based compensation (excluding Mr. Dickson, who joined McDermott on October 31, 2013);

NEO annual incentives being comprised 100% of performance-based compensation (excluding Mr. Dickson); and

NEO target long-term incentive, or LTI, compensation being comprised 75% of performance-based compensation (excluding Mr. Dickson).

Although McDermott had revenues for the year ended December 31, 2013 of $2.7 billion and year-end backlog of $4.8 billion, our company recognized an operating loss in 2013, which, in accordance with our Compensation Committee’s philosophy and program, and based on the value of our common stock at year end, resulted in:

No NEO annual bonus awards being earned with respect to 2013.

NEO stock options granted in 2011, 2012 and 2013 having no realizable value as of December 31, 2013.

NEO performance shares granted in 2011, 2012 and 2013 having no realizable value as of December 31, 2013.

The following table summarizes the 2013 performance-based compensation opportunities, as compared to the realizable value of such opportunities as of December 31, 2013, for each of our NEOs, excluding Mr. Dickson:

2013 Performance-Based Compensation Opportunity vs.

Realizable Value as of December 31, 2013

ii

| (1) | Opportunity Values for EICP are disclosed at the NEOs’ target EICP award. |

| (2) | Opportunity Values for performance shares and stock options are disclosed at the grant date fair value of the respective awards. |

| (3) | The 2013 realizable values shown above are measured as of December 31, 2013. The value of performance share awards shown above is based on the estimated payout as a percent of target, or 0% of the performance shares granted in 2013, multiplied by the closing price of our common stock as reported on the New York Stock Exchange as of December 31, 2013 ($9.16). The number of the performance shares granted in 2013 that ultimately vest, if any, will be determined by reference to performance goals over a three-year period. See “Long-Term Incentives.” The vesting of any of these performance shares would impact the future realizable value of these performance share awards. In addition, an increase in our stock price compared to our stock price at December 31, 2013 may impact the future realizable value of the stock option awards granted in 2013. |

Compensation and Corporate Governance Policies and Procedures

The Board has implemented several policies and structures that we believe are “best practices” in corporate governance, including:

Separating the Chairman of the Board and Chief Executive Officer roles;

Holding Board meeting executive sessions with independent directors only present;

Maintaining minimum stock ownership guidelines applicable to directors and executive officers;

Approving a policy prohibiting all directors, officers and employees from engaging in “short sales” or trading in puts, calls or other options on McDermott’s common stock, and from engaging in hedging transactions and from holding McDermott shares in a margin account or pledging McDermott shares as collateral for a loan;

Eliminating excise tax gross-ups; and

The Compensation Committee of the Board of Directors engaging Pay Governance LLC, an independent executive compensation consultant.

Advisory Vote to Approve Named Executive Officer Compensation — Item 2

Our stockholders have the opportunity to cast a non-binding advisory vote on the compensation of our named executive officers. Last year, over 96% of the votes cast on this proposal were in favor of our executive compensation program. We recommend that you review our Compensation Discussion and Analysis beginning on page 23, which explains the philosophy of the Compensation Committee and its actions and decisions during 2013 regarding our compensation programs. Our Board of Directors recommends that stockholders vote “For” the advisory vote to approve named executive officer compensation.

Approval of the 2014 McDermott International, Inc. Long-Term Incentive Plan — Item 3

We are asking our stockholders to approve the 2014 McDermott International, Inc. Long-Term Incentive Plan (the “2014 LTIP”) to replace the 2009 McDermott International, Inc. Long-Term Incentive Plan (the “2009 LTIP”). On March 6, 2014, our Board of Directors adopted, subject to stockholder approval, the 2014 LTIP reserving 6,600,000 shares for issuance pursuant to awards thereunder. A total of 774,507 shares remain available for issuance under the 2009 LTIP as of March 7, 2014. The 2014 LTIP would also provide certain updates and governance-related enhancements as described below under “Vote to Approve the 2014 LTIP (Item 3).”

iii

The proposed adoption of the 2014 LTIP will allow us to continue to fully utilize equity incentive compensation as a means of aligning the interests of participants with those of our stockholders and providing participants with further incentives for outstanding performance. As a result, we believe strongly that the adoption of the 2014 LTIP is important to our ability to recruit and retain executive officers, directors and key employees with outstanding ability and experience essential to our long-term growth and financial success.

Our Board of Directors recommends that stockholders vote “For” the approval of the 2014 LTIP.

Ratification of Appointment of Deloitte & Touche LLP as Auditors — Item 4

Our Board of Directors has ratified our Audit Committee’s appointment of Deloitte & Touche LLP as McDermott’s independent registered public accounting firm for the year ending December 31, 2014, and as a matter of good governance, we are seeking stockholder ratification of this appointment.

Our Board of Directors recommends that stockholders vote “For” the ratification of Deloitte & Touche LLP as McDermott’s independent registered public accounting firm for the year ending December 31, 2014.

Communicating with the Board of Directors

Stockholders or other interested persons may send written communications to the independent members of our Board, addressed to Board of Directors (independent members), c/o McDermott International, Inc., Corporate Secretary’s Office, 757 N. Eldridge Pkwy., Houston, Texas 77079.

iv

QUESTIONS AND ANSWERS ABOUT THE

ANNUAL MEETING OF STOCKHOLDERS AND VOTING

What is the purpose of these proxy materials?

As more fully described in the Notice, the Board of Directors of McDermott International, Inc. (“McDermott”) has made these materials available to you in connection with our 20122014 Annual Meeting of Stockholders, which will take place on May 10, 20126, 2014 at 10:00 a.m., local time (the “Annual Meeting” or “Meeting”). We mailed the Notice to our stockholders beginning March 30, 2012,24, 2014, and our proxy materials were posted on the Web site referenced in the Notice on that same date.

McDermott, on behalf of its Board of Directors, is soliciting your proxy to vote your shares at the 20122014 Annual Meeting of Stockholders. We solicit proxies to give all stockholders of record an opportunity to vote on matters that will be presented at the Annual Meeting. In this proxy statement, you will find information on these matters, which is provided to assist you in voting your shares.

Who will pay for the cost of this proxy solicitation?

We will bear all expenses incurred in connection with this proxy solicitation, which we expect to conduct primarily by mail. We have engaged The Proxy Advisory Group, LLC to assist in the solicitation for a fee that will not exceed $12,500, plus out-of-pocket expenses. In addition, our officers and regular employees may solicit your proxy by telephone, by facsimile transmission or in person, for which they will not be separately compensated. If your shares are held through a broker or other nominee (i.ei.e.., in “street name”) and you have requested printed versions of these materials, we have requested that your broker or nominee forward this proxy statement to you and obtain your voting instructions, for which we will reimburse them for reasonable out-of-pocket expenses. If your shares are held through the McDermott Thrift Plan and you have requested printed versions of these materials, the trustee of that plan has sent you this proxy statement and you can instruct the trustee on how to vote your plan shares.

Who is entitled to vote at, and who may attend, the Annual Meeting?

Our Board of Directors selected March 12, 20127, 2014 as the record date (the “Record Date”) for determining stockholders entitled to vote at the Annual Meeting. This means that if you owned McDermott common

stock on the Record Date, you may vote your shares on the matters to be considered by our stockholders at the Annual Meeting.

There were 235,564,418237,417,010 shares of our common stock outstanding on the Record Date. Each outstanding share of common stock entitles its holder to one vote on each matter to be acted on at the meeting.

Attendance at the meeting is limited to stockholders and beneficial owners as of the record date or duly appointed proxies. No guests will be admitted, except for guests invited by McDermott. Registration will begin at 9:00 a.m., and the meeting will begin promptly at 10:00 a.m. If your shares are held in “street name” through a broker, bank, trustee or other nominee, you are a beneficial owner, and beneficial owners will need to show proof of beneficial ownership, such as a copy of a brokerage account statement, reflecting stock ownership as of the record date in order to be admitted to the meeting. If you are a proxy holder for a stockholder, you will need to bring a validly executed proxy naming you as the proxy holder, together with proof of record ownership of the stockholder naming you as proxy holder. Please note that you may be asked to present valid photo identification, such as a valid driver’s license or passport, when you check in for registration. No cameras, recording equipment or other electronic devices will be allowed to be brought into the meeting room by stockholders or beneficial owners.

What is the difference between holding shares as a stockholder of record and as a beneficial owner through a brokerage account or other arrangement with a holder of record?

If your shares are registered in your name with McDermott’s transfer agent and registrar, Computershare Trust Company, N.A., you are the “stockholder of record” of those shares. The Notice and the proxy materials have been provided or made available directly to you by McDermott.

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” but not the holder of record of those shares, and the Notice and the proxy materials have been forwarded to you by your broker, bank or other holder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote your shares by using the voting instruction card or by following their instructions for voting by telephone or on the Internet.

How do I cast my vote?

Most stockholders can vote by proxy in three ways:

| • | by Internet atwww.proxyvote.com; |

by telephone; or

by mail.

If you are a stockholder of record, you can vote your shares in person at the Annual Meeting or vote now by giving us your proxy. You may give us your proxy by following the instructions included in the Notice or, if you received a printed version of these proxy materials, in the enclosed proxy card. If you want to vote by mail but have not received a printed version of these proxy materials, you may request a full packet of proxy materials throughby following the instructions in the Notice. If you vote using either the telephone or the Internet, you will save us mailing expense.

By giving us your proxy, you will be directing us how to vote your shares at the meeting. Even if you plan on attending the meeting, we urge you to vote now by giving us your proxy. This will ensure that your vote is represented at the meeting. If you do attend the meeting, you can change your vote at that time, if you then desire to do so.

If you are the beneficial owner but not the holder of record, of shares, you should refer to the instructions provided by your broker or nominee for further information. The broker or nominee that holds your shares has the authority to vote them, absent your approval, only as to matters for which they have discretionary authority under the applicable New York Stock Exchange (“NYSE”) rules. Neither the election of directors, nor the advisory vote to approve named executive officer compensation, nor the approval of the 2014 LTIP are considered routine matters. That means that brokers may not vote your shares with respect to those matters if you have not given your broker specific instructions as to how to vote. Please be sure to give specific voting instructions to your broker.

If you received a printed version of these proxy materials, you should have received a voting instruction form from your broker or nominee that holds your shares. For shares of which you are the beneficial owner but not the holder of record, follow the instructions contained in the Notice or voting instruction form to vote by Internet, telephone or mail. If you want to vote by mail but have not received a printed version of these proxy materials, you may request a full packet of proxy materials as instructed by the Notice. If you want to vote your shares in person at the Annual Meeting, you must obtain a valid proxy from your broker or nominee. You should contact your broker or nominee or refer to the instructions provided by your broker or nominee for further information. Additionally, the availability of telephone or Internet voting depends on the voting process used by the broker or nominee that holds your shares.

Why did I receive more than one Notice or proxy statement and proxy card or voting instruction form?

You may receive more than one Notice, or proxy statement, and proxy card or voting instruction form if your shares are held through more than one account (e.g., through different brokers or nominees). Each proxy card or voting instruction form only covers those shares of common stock held in the applicable account. If you hold shares in more than one account,

you will have to provide voting instructions as to alleach of your accounts in order to vote all your shares.

What can I do if I change my mind after I vote?

If you are a stockholder of record, you may change your vote by written notice to our Corporate Secretary, by granting a new proxy before the Annual Meeting or by voting in person at the Annual Meeting. Unless you attend the meeting and vote your shares in person, you should change your vote before the meeting using the same method (by telephone, Internet or mail) that you first used to vote your shares. That way, the inspectors of election for the meeting will be able to verify your latest vote.

If you are the beneficial owner, but not the holder of record, of shares, you should follow the instructions in the information provided by your broker or nominee to change your vote before the meeting. If you want to change your vote as to shares of which you are the beneficial owner by voting in person at the Annual Meeting, you must obtain a valid proxy from the broker or nominee that holds those shares for you.

What is a broker non-vote?

If you are a beneficial owner whose shares are held of record by a broker or other holder of record, you must instruct the broker or other holder of record how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have discretionary authority to vote. This is called a “broker non-vote.” In these cases, the broker or other holder of record can include your shares as being present at the Annual Meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under the rules of the New York Stock Exchange (“NYSE”).NYSE.

With respect to this Annual Meeting, if you are a beneficial owner whose shares are held by a broker or other holder of record, your broker or other holder of record has discretionary voting authority under NYSE rules to vote your shares on the ratification of Deloitte & Touche LLP (“Deloitte”), even if it has not received voting instructions from you. However, such holder does not have discretionary authority to vote on the election of directors, or the advisory vote to approve named executive officer compensation or to approve the 2014 LTIP without instructions from you, in which case a broker non-vote will occur and your shares will not be voted on those matters.

What is the quorum for the Annual Meeting?

The Annual Meeting will be held only if a quorum exists. The presence at the meeting, in person or by proxy, of holders of a majority of our outstanding shares of common stock as of the Record Date will constitute a quorum. If you attend the meeting or vote your shares by Internet, telephone or mail, your shares will be counted toward a quorum, even if you abstain from voting on a particular matter. Broker non-votes will be treated as present for the purpose of determining a quorum.

Which items will be voted on at the Annual Meeting?

At the Annual Meeting, we are asking you to vote on the following:

the election of John F. Bookout, III, Roger A. Brown, David Dickson, Stephen G. Hanks, Stephen M. Johnson, D. Bradley McWilliams, Thomas C. Schievelbein,Gary P. Luquette, William H. Schumann, III, Mary L. Shafer-Malicki and David A. Trice to our Board of Directors, each for a term of one year;

the advisory vote to approve named executive officer compensation;

the approval of the 2014 LTIP; and

the ratification of our Audit Committee’s appointment of Deloitte as our independent registered public accounting firm for the year ending December 31, 2012.2014.

We are not aware of any other matters that may be presented or acted on at the Annual Meeting. If you vote by signing and returning the enclosed proxy card or using the telephone or Internet voting procedures, the individuals named as proxies on the card may vote your shares, in their discretion, on any other matter requiring a stockholder vote that comes before the meeting.

What are the Board’s voting recommendations?

For the reasons set forth in more detail later in this proxy statement, our Board recommends a vote:

FOR the election of each director nominee;

FOR the advisory vote to approve named executive officer compensation;

FOR the approval of the 2014 LTIP; and

FOR the ratification of our Audit Committee’s appointment of Deloitte as our independent registered public accounting firm for the year ending December 31, 2012.2014.

What are the voting requirements to elect the Directors and to approve each of the proposals discussed in this proxy statement?

Our By-Laws provide that, in all matters arising at a stockholders’ meeting,Each proposal requires the affirmative vote of a majority of the voting power of our outstanding shares present in person or represented by proxy at the meeting and entitled to vote and actually voting on the matter shall be necessarymatter. Because abstentions and sufficient for approval, except where some larger percentage is required by applicable law or our Articles of Incorporation. No such larger percentage is applicable to any of the items we are asking you to vote on at the Annual Meeting. Because abstentionsbroker non-votes are not actual votes with respect to a proposal, they will have no effect on the outcome of the vote on aany proposal.

Our Corporate Governance Guidelines provide that, in an uncontested election of directors, the Board expects any incumbent director nominee who does not receive a “FOR” vote by a majority of shares present in person or by proxy and entitled to vote and actually voting on the matter to promptly tender his or her resignation to the Governance Committee, subject to acceptance by our Board. The Governance Committee will then make a recommendation to the Board with respect to the director nominee’s resignation and the Board will consider the recommendation and take appropriate action within 120 days from the date of the certification of the election results.

What happens if I do not specify a choice for a proposal when returning a proxy or do not cast my vote?

You should specify your choice for each proposal on your proxy card or voting instruction form. Shares represented by proxies will be voted in accordance with the instructions given by the stockholders.

If you are a stockholder of record and your proxy card is signed and returned without voting instructions, it will be voted according to the recommendations of our Board. If you do not return your proxy card or cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

If you are the beneficial owner, but not the holder of record, of shares and fail to provide voting instructions, your broker or other holder of record is permitted to vote your shares on the ratification of Deloitte as our independent registered public

accounting firm. However, absent instructions from you, your broker or other holder of record may not vote on the election of directors, or the advisory vote to approve named executive officer compensation or the approval of the 2014 LTIP, and no votes will be cast on your behalf for those matters.

Is my vote confidential?

All voted proxies and ballots will be handled in a manner intended to protect your voting privacy as a stockholder. Your vote will not be disclosed except:

to meet any legal requirements;

in limited circumstances such as a proxy contest in opposition to our Board of Directors;

to permit independent inspectors of election to tabulate and certify your vote; or

to adequately respond to your written comments on your proxy card.

ELECTIONELECTION OF DIRECTORS DIRECTORS

(ITEM 1)

Election Process.Our Articles of Incorporation provide that, at each annual meeting of stockholders, all directors shall be elected annually for a term expiring at the next succeeding annual meeting of stockholders or until their respective successors are duly elected and qualified. Accordingly, our Board has nominated the following eight persons for reelection as directors at this year’s Annual Meeting, for a term of one year: John F. Bookout, III, Roger A. Brown, Stephen G. Hanks, Stephen M. Johnson, D. Bradley McWilliams, Thomas C. Schievelbein,William H. Schumann, III, Mary L. Shafer-Malicki and David A. Trice. Additionally, our Board appointed Gary P. Luquette as a director on October 18, 2013 and David Dickson as a director on December 16, 2013, and has nominated each for election as a director at this year’s Annual Meeting, for a term of one year.

Our By-Laws provide that (1) a person shall not be nominated for election or reelection to our Board of Directors if such person shall have attained the age of 72 prior to the date of election or reelection, and (2) any director who attains the age of 72 during his or her term shall be deemed to have resigned and retired at the first Annual Meeting following his or her attainment of the age of 72. Accordingly, a director nominee may stand for election if he or she has

not attained the age of 72 prior to the date of election or reelection.

Unless otherwise directed, the persons named as proxies on the enclosed proxy card intend Pursuant to vote “FOR” the election of eachthese By-Law requirements, D. Bradley McWilliams, our Chairman of the nominees. If any nominee should become unavailableBoard of Directors and the Chairman of our Finance Committee, will retire from our Board after eleven years of service, effective at this year’s Annual Meeting. In connection therewith, we expect to elect a new Chairman of the Board of Directors and Chairman of the Finance Committee.

Director Qualifications. Our Governance Committee has determined that a candidate for election the shares will be voted for such substitute nominee as may be proposed byto our Board of Directors. However, we are Directors must meet specific minimum qualifications. Each candidate should:

have a record of integrity and ethics in his/her personal and professional life;

have a record of professional accomplishment in his/her field;

be prepared to represent the best interests of our stockholders;

not awarehave a material personal, financial or professional interest in any competitor of any circumstancesours; and

be prepared to participate fully in Board activities, including active membership on at least one Board committee and attendance at, and active participation in, meetings of the Board and the committee(s) of which he or she is a member, and not have other personal or professional commitments that would, preventin the Governance Committee’s sole judgment, interfere with or limit his or her ability to do so.

In addition, the Governance Committee also considers it desirable that candidates contribute positively to the collaborative culture among Board members and possess professional and personal experiences and expertise relevant to our business and industry.

While McDermott does not have a specific policy addressing board diversity, the Board recognizes the benefits of a diversified board and believes that any search for potential director candidates should consider diversity as to gender, ethnic background and personal and professional experiences. The Governance Committee solicits ideas for possible candidates from a number of sources — including independent director candidate search firms, members of the nomineesBoard and our senior level executives.

Director Nominations. Any stockholder may nominate one or more persons for election as one of our directors at an annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our By-Laws. See “Stockholders’ Proposals” in this proxy statement and our By-Laws, which may be found on our Web site atwww.mcdermott.comat “About Us — Leadership & Corporate Governance — Corporate Governance.”

The Governance Committee will consider candidates identified through the processes described above and will evaluate each of them, including incumbents, based on the same criteria. The Governance Committee also takes into account the contributions of incumbent directors as Board members and the benefits to us arising from serving.their experience on the Board. Although the Governance Committee will consider candidates identified by stockholders, the Governance Committee has sole discretion whether to recommend those candidates to the Board.

In 2013, our Governance Committee engaged Russell Reynolds Associates (“Russell Reynolds”), an independent director search firm, in order to assist in selecting director candidates. After review and consideration of prospective candidates identified by Russell Reynolds, Mr. Luquette was appointed to the Board on October 18, 2013 in consideration of his extensive experience in the oil and gas industry, knowledge of our customers and other qualifications.

2014 Nominees.In nominating individuals to become members of the Board of Directors, the Governance Committee considers the experience, qualifications and skills of each potential member. Each nominee brings a strong and unique background and set of skills to the Board, giving the Board as a whole competence and experience in a wide variety of areas. The Governance Committee and the Board of Directors considered the following information, including the specific experience, qualifications, attributes or skills, in concluding each individual was an appropriate nominee to serve as a member of our Board for the term commencing at this year’s Annual Meeting (ages are as of May 10, 2012)6, 2014).

Unless otherwise directed, the persons named as proxies on the enclosed proxy card intend to vote “FOR” the election of each of the nominees. If any nominee should become unavailable for election, the shares will be voted for such substitute nominee as may be proposed by our Board of Directors. However, we are not aware of any circumstances that would prevent any of the nominees from serving.

Our Board recommends that stockholders vote “FOR” each of the nomineesfollowing named below.nominees.

| ||

| Director Since 2006 | |

Finance Committee Member Governance Committee Member | ||

Mr. Bookout, 60, has served as a Managing Director of Kohlberg Kravis Roberts & Co., a private equity firm, since March 2008. Previously, he served as Senior Advisor to First Reserve Corporation, a private equity firm specializing in the energy industry, from 2006 to March 2008. Until 2006, he was a director of McKinsey & Company, a global management consulting firm, which he joined in 1978. Mr. Bookout previously served as a director of Tesoro Corporation from 2006-2010. The Board of Directors is nominating Mr. Bookout in consideration of his: | ||

• global experience with the petroleum refining and marketing industry and oil and gas exploration and development industry; • expertise in private equity and finance; and • experience as a board member of public companies. | ||

Roger A. Brown | Director Since | |

Governance Committee Chairman Compensation Committee Member | ||

From 2005 until his retirement in 2007, Mr. Brown, 69, was Vice President, Strategic Initiatives of Smith International, Inc., a supplier of goods and services to the oil and gas exploration and production industry, the petrochemical industry and other industrial markets. Mr. Brown was President of Smith Technologies (a business unit of Smith International, Inc.) from 1998 until 2005. Mr. Brown has also served as a director of Ultra Petroleum Corp. since 2007 and Boart Longyear Limited since 2010. The Board of Directors is nominating Mr. Brown in consideration of his: | ||

• executive leadership experience in the oil and gas exploration and production industry; • knowledge of corporate governance issues; and • experience as a board member of public companies. | ||

Age — 58

Finance Committee — Member

Governance Committee — Member

Mr. Bookout has served as a Managing Director of Kohlberg Kravis Roberts & Co., a private equity firm, since March 2008. Previously, he served as Senior Advisor to First Reserve Corporation, a private equity firm specializing in the energy industry, from 2006 to March 2008. Until 2006, he was a director of McKinsey & Company, a global management consulting firm, which he joined in 1978. Mr. Bookout previously served as a director of Tesoro Corporation from 2006-2010. The Board of Directors is nominating Mr. Bookout in consideration of his:

global experience with the petroleum refining and marketing industry and oil and gas exploration and development industry;

expertise in private equity and finance; and

experience as a board member of public companies, including McDermott.

David Dickson | Director Since | |

President and Chief Executive Officer | ||

Mr. Dickson, 46, has served as a member of our Board of Directors and as President and Chief Executive Officer since December 2013, prior to which he served as our Executive Vice President and Chief Operating Officer from October 2013. Mr. Dickson has over 23 years of offshore oilfield engineering and construction business experience, including 11 years of experience with Technip S.A. and its subsidiaries. From September 2008 to October 2013, he served as President of Technip U.S.A. Inc., with oversight responsibilities for all of Technip’s North American operations. In addition to being the President of Technip U.S.A. Inc., Mr. Dickson also had responsibility for certain operations in Latin America, including Mexico, Venezuela, Colombia and the Caribbean. Mr. Dickson also supported the Technip organization by managing key customer accounts with international oil companies based in the United States. The Board of Directors is nominating Mr. Dickson in consideration of his: | ||

• position as our President and Chief Executive Officer; • executive leadership experience in and significant knowledge of the offshore oilfield engineering and construction business; and • broad knowledge of the expectations of our core customers. | ||

Age — 67

Compensation Committee — Member

Governance Committee — Chairman

From 2005 until his retirement in 2007, Mr. Brown was Vice President, Strategic Initiatives of Smith International, Inc., a supplier of goods and services to the oil and gas exploration and production industry, the petrochemical industry and other industrial markets. Mr. Brown was President of Smith Technologies (a business unit of Smith International, Inc.) from 1998 until 2005. Mr. Brown has also served as a director of Ultra Petroleum Corp. since 2007 and Boart Longyear Limited since 2010. The Board of Directors is nominating Mr. Brown in consideration of his:

executive leadership experience in the oil and gas exploration and production industry;

knowledge of corporate governance issues; and

experience as a board member of public companies, including McDermott.

Stephen G. Hanks | Director Since 2009 | |

Audit Committee Member Finance Committee Member | ||

Mr. Hanks, 63, served in various roles over a 30-year career with Washington Group International, Inc. (and its predecessor, Morrison Knudsen Corporation), an integrated construction and management services company, and from 2000 through 2007 served as President, Chief Executive Officer and a member of its board of directors. Mr. Hanks has also served as a director of Lincoln Electric Holdings, Inc. since 2006 and as a director of The Babcock & Wilcox Company since 2010. The Board of Directors is nominating Mr. Hanks in consideration of his: | ||

• experience in executive leadership, including his position as the Chief Executive Officer of Washington Group; • background and knowledge in the areas of accounting, auditing and financial reporting, having previously served as a Chief Financial Officer; • experience in the engineering and construction industry; and • experience as a board member of public companies. | ||

Age — 61

Audit Committee — Member

Finance Committee — Member

From November 2007 until his retirement in January 2008, Mr. Hanks was President of the Washington Division of URS Corporation, an engineering, construction and technical services company, and he also served as a member of URS Corporation’s Board of Directors during that time. Previously, from June 2001 to November 2007 he was President and CEO of Washington Group International, Inc. (“Washington Group”), an integrated engineering, construction and management services company which was acquired by URS Corporation in 2007, and also served on its Board of Directors. Mr. Hanks has also served as a director of Lincoln Electric Holdings, Inc. since 2006 and as a director of The Babcock & Wilcox Company since 2010. The Board of Directors is nominating Mr. Hanks in consideration of his:

experience in executive leadership, including his position as the Chief Executive Officer of Washington Group;

background and knowledge in the areas of accounting, auditing and financial reporting, having previously served as a Chief Financial Officer;

experience in the engineering and construction industry; and

experience as a board member of public companies, including McDermott.

Gary P. Luquette | Director Since |

Age — 60

Chairman of the Board, President and Chief Executive Officer

Mr. Johnson has been President and Chief Executive Officer of McDermott and a member of our Board since July 2010, and has served as Chairman of our Board since May 2011. Previously, he served as President and Chief Executive Officer of J. Ray McDermott, S.A., one of our subsidiaries, from January 2010 to July 2010, and President and Chief Operating Officer of McDermott from April 2009 to December 2009. From 2001 to 2008, Mr. Johnson was Senior Executive Vice President and Member, Office of the Chairman, at Washington Group and at URS Corporation, which acquired Washington Group in 2007. The Board of Directors is nominating Mr. Johnson in consideration of his:

position as our Chairman, President and Chief Executive Officer;

experience in executive leadership for public companies in the engineering and construction industry, encompassing global experience, technical knowledge and complex business and financial structuring, as well as experience in the oil & gas, chemical processing, power generation, transportation, mining and government businesses;

operational and financial expertise in the engineering and construction industry, both in the United States and in international markets, including having resided, worked or led complex business transactions in the United States, Europe, Africa, the Middle East and Asia Pacific regions;

experience as a recognized leader in the area of risk management within the engineering and construction industry, having participated in the founding of the Engineering & Construction Risk Institute, a global organization focused on developing best practices in risk management, of which he served as Chairman; and

broad knowledge of the demands and expectations of our core customers.

Compensation Committee Member Finance Committee Member | |||

From 2006 until his retirement in September 2013, Mr. Luquette, 58, served as President, Chevron North America Exploration and Production, a unit of Chevron Corporation. Previously, he held key exploration and production positions with Chevron in Europe, California, Indonesia and Louisiana. Mr. Luquette currently serves as a director of Frank’s International N.V. since November 2013. The Board of Directors is nominating Mr. Luquette in consideration of his: | |||

• experience in the upstream energy and supporting infrastructure businesses; • knowledge of and experience with our core customers; • significant international experience, having executive or management experience in Europe and Asia Pacific; and • experience as a board member of public companies. | |||

Age — 70

Lead Director

Audit Committee — Member

Finance Committee — Chairman

Mr. McWilliams has served as our Lead Director since May 2011. From April 1995 until his retirement in April 2003, Mr. McWilliams was Senior Vice President and Chief Financial Officer of Cooper Industries Ltd., a worldwide manufacturer of electrical products, tools and hardware. He was Vice President of Cooper Industries from 1982 until April 1995. Mr. McWilliams has served as a director and Lead Director of The Babcock & Wilcox Company since 2010 and previously served as a director of Kronos Incorporated from 1993 to 2005. The Board of Directors is nominating Mr. McWilliams in consideration of his:

background in public accounting;

background and knowledge in the areas of accounting, auditing and financial reporting, having served as a Chief Financial Officer of a public company; and

experience as a board member and lead director of public companies, including McDermott.

William H. Schumann, III | Director Since | |

Audit Committee Member Governance Committee Member | ||

From February 2007 until August 2012, Mr. Schumann, 63, served as Executive Vice President of FMC Technologies, Inc. (“FMC”), a global provider of technology solutions for the energy industry. Mr. Schumann previously served in the following capacities at FMC Technologies and its predecessor, FMC Corporation: Chief Financial Officer from 2001 until his retirement from that position in December 2011; Vice President, Corporate Development from 1998 to 1999; Vice President and General Manager, Agricultural Products Group from 1995 to 1998; Regional Director, North America Operations, Agricultural Products Group from 1993 to 1995; Executive Director of Corporate Development from 1991 to 1993, and other various management positions from the time he joined FMC in 1981. Mr. Schumann currently serves as Chairman of the Board of Avnet, Inc., which board he has served on since February 2010, on the board of directors of AMCOL International Corporation since August 2012 and on the board of directors of URS Corporation since March 2014. He also previously served on the board of directors of UAP Holding Corp. from 2005 to 2008. The Board of Directors is nominating Mr. Schumann in consideration of his: | ||

• executive leadership experience in the energy industry; • background and knowledge in the areas of accounting, auditing and financial reporting, having served as a Chief Financial Officer of a public company; and • experience as a board member of public companies, including as a chairman of a public company. | ||

Age — 58

Compensation Committee — Chairman

Governance Committee — Member

Mr. Schievelbein has served as interim President and Chief Executive Officer of The Brinks Company, a secure transportation, cash handling and security-related services company, since December 2011. Previously, Mr. Schievelbein served as President of Northrop Grumman Newport News, a subsidiary of the Northrop Grumman Corporation, a global defense company, from November 2001 until his retirement in November 2004; and as Executive Vice President and Chief Operating Officer of Newport News Shipbuilding, Inc. from October 1995 to October 2001. Mr. Schievelbein has also served as a director of Huntington Ingalls Industries, Inc. since 2011, The Brinks Company since 2009, including as interim Chairman of the Board from November to December 2011, and New York Life Insurance Company since 2006. The Board of Directors is nominating Mr. Schievelbein in consideration of his:

operational, business technology development and risk mitigation and control experience gained through executive leadership;

experience with the oversight of compensation strategies and plans; and

experience as a board member of public companies, including McDermott.

Mary L. Shafer-Malicki | Director Since 2011 | |

Compensation Committee Chairman Finance Committee Member | ||

From July 2007 until her retirement in March 2009, Ms. Shafer-Malicki, 53, was Senior Vice President and Chief Executive Officer of BP Angola, a subsidiary of BP p.l.c., an oil and natural gas exploration, production, refining and marketing company. Previously, Ms. Shafer-Malicki served as Chief Operating Officer of BP Angola from January 2006 to June 2007 and in various other international engineering and managerial positions with BP p.l.c. Ms. Shafer-Malicki has also served as a director of Ausenco Limited since January 2011 and John Wood Group PLC since June 2012. The Board of Directors is nominating Ms. Shafer-Malicki in consideration of her: | ||

• experience in the upstream energy and supporting infrastructure businesses; • knowledge of and experience with our core customers; • executive experience and business leadership skills, including operations, strategy, commercial, safety and supply chain management; • significant international experience, having executive or management experience in Europe, Asia Pacific and Africa; and • experience as a board member of public companies. | ||

Age — 51

Compensation Committee — Member

Finance Committee — Member

From July 2007 until her retirement in March 2009, Ms. Shafer-Malicki was Senior Vice President and Chief Executive Officer of BP Angola, a subsidiary of BP p.l.c., an oil and natural gas exploration, production, refining and marketing company. Previously, Ms. Shafer-Malicki served as Chief Operating Officer of BP Angola from January 2006 to June 2007; and various other international engineering and managerial positions with BP p.l.c. Ms. Shafer-Malicki has also served as a director of Ausenco Limited since January 2011. The Board of Directors is nominating Ms. Shafer-Malicki in consideration of her:

experience in the upstream energy and supporting infrastructure businesses;

knowledge of and experience with our core customers;

executive experience and business leadership skills, including operations, strategy, commercial, safety and supply chain management; and

significant international experience, having executive or management experience in Europe, Asia Pacific and Africa.

David A. Trice | Director Since 2009 | |

Audit Committee Chairman Compensation Committee Member | ||

From February 2000 until his retirement in May 2009, Mr. Trice, 66, was Chief Executive Officer of Newfield Exploration Company, an oil and natural gas exploration and production company, and served as Chairman of its board from September 2004 to May 2010. Mr. Trice has served as a director of New Jersey Resources Corporation since 2004 and QEP Resources, Inc. since 2011. Mr. Trice previously served as a director of Grant PrideCo, Inc. from 2003 to 2008 and Hornbeck Offshore Services, Inc. from 2002 to 2011. The Board of Directors is nominating Mr. Trice in consideration of his: | ||

• executive experience as a Chief Executive Officer of a public company; • experience in the oil and gas exploration and production business; • background and knowledge in the areas of accounting, auditing and financial reporting; and • experience as a board member of public companies, including as a chairman of a public company. | ||

Age — 64

Audit Committee — Chairman

Compensation Committee — Member

From February 2000 until his retirement in May 2009, Mr. Trice was Chief Executive Officer of Newfield Exploration Company, an oil and natural gas exploration and production company, and served as Chairman of its board from September 2004 to May 2010. Mr. Trice has served as a director of New Jersey Resources Corporation since 2004 and QEP Resources, Inc. since 2011. Mr. Trice previously served as a director of Grant PrideCo, Inc. from 2003 to 2008 and Hornbeck Offshore Services, Inc. from 2002 to 2011. The Board of Directors is nominating Mr. Trice in consideration of his:

executive experience as a Chief Executive Officer of a public company;

experience in the oil and gas exploration and production business;

background and knowledge in the areas of accounting, auditing and financial reporting; and

experience as a board member of public companies, including as a chairman of a public company.

CORPORATE GOVERNANCECORPORATE GOVERNANCE

We maintain a corporate governance section on our Web site which contains copies of our principal governance documents. The corporate governance section may be found atwww.mcdermott.comatunder “About Us — Leadership & Corporate Governance — Corporate Governance” and “About Us — Leadership & Corporate Governance — Board Committees.” The corporate governance section contains the following documents:

By-Laws

Corporate Governance Guidelines

Code of Ethics for CEO and Senior Financial Officers

Board of Directors Conflicts of Interest Policies and Procedures

Audit Committee Charter

Compensation Committee Charter

Finance Committee Charter

Governance Committee Charter

In addition, our Code of Business Conduct may be found on our Web site atwww.mcdermott.com at “About Us — Leadership & Corporate Governance.”

The New York Stock Exchange listing standards require our Board of Directors to be comprised of at least a majority of independent directors. For a director to be considered independent, our Board must determine that the director does not have any direct or indirect material relationship with us. To assist it in determining director independence, and as permitted by New York Stock ExchangeNYSE rules then in effect, the Board previously established categorical standards which conform to, or are more exacting than, the independence requirements in the New York Stock ExchangeNYSE listing standards. These standards are contained in theour Corporate Governance Guidelines, which can be found on our Web site atwww.mcdermott.comunder “About Us — Leadership & Corporate Governance — Corporate Governance.”

Based on these independence standards, our Board of Directors has affirmatively determined that the following directors are independent and meet our categorical independence standards:

John F. Bookout, III | D. Bradley McWilliams | |

Roger A. Brown | William H. Schumann, III | |

Stephen G. Hanks | Mary L. Shafer-Malicki | |

Gary P. Luquette | David A. Trice | |

In addition, our Board also determined, prior to his retirement in May 2011, that Mr. Ronald C. Cambre was independent and met our categorical standards.

In determining the independence of the directors, our Board considered ordinary course transactions between us and other entities with which the directors are associated, none of which were determined to constitute a material relationship with us. Messrs. Brown, SchievelbeinLuquette, Schumann and Trice have no relationship with McDermott, except as a director and stockholder. Mr.Messrs. Bookout and Hanks and Ms. Shafer-Malicki are directors of entities with which we transact business in the ordinary course. Mr. Bookout is an outside consultantManaging Director for an affiliate of an entitya private equity firm which has invested in entities with which we transact business in the ordinary course. Messrs. Hanks and McWilliams are directors of The Babcock & Wilcox Company (“B&W”), which pursuant to the transition services agreements entered into by McDermott and B&W prior to the spin-off of B&W (the “Spin-off”), McDermott has transacted with following the Spin-off. Our Board also considered unsolicited contributions by us to charitable organizations with which the directors were associated. Additionally, noassociated, including one in 2013 to a charitable organization for which Mr. McWilliams serves as a director. No director is related to any executive or significant shareholderstockholder of McDermott, nor is any director, with the exception of Mr. Johnson,Dickson, a current or former employee of McDermott.

Our independent directors meet in executive session without management on a regular basis. Currently, Mr. D. Bradley McWilliams, our Lead Director,Chairman of the Board of Directors, serves as the presiding director for thesethose executive sessions.

Stockholders or other interested persons may send written communications to the independent members of our Board, addressed to Board of Directors (independent members), c/o McDermott International, Inc., Corporate Secretary’s Office, 757 N. Eldridge Pkwy., Houston, Texas 77079. Information regarding this process is posted on our Web site atwww.mcdermott.comunder “About Us — Leadership & Corporate Governance — Independent Director Access Information.”

Board of Directors and Its Committees

Our Board met ninetwelve (12) times during 2011.2013. All directors attended 75% or more of the meetings of the Board and of the committees on which they served during 2011.2013. In addition, as reflected in our Corporate Governance Guidelines, we have adopted a policy that each member of our Board must make reasonable efforts to attend our Annual Meeting. All directors then serving on the Board attended our 20112013 Annual Meeting, with the exception of Ms. Shafer-Malicki, who was unable to attend due to a pre-existing conflict prior to joining our Board in February 2011.Meeting.

Board Leadership StructureStructure.

Commencing on May 6, 2011, Mr. JohnsonMcWilliams has served as Chairman of the Board in addition to his service as Chief Executive Officer. Prior to that date,since Mr. Cambre served as Chairman of the Board. In connection with Mr. Cambre’s retirement,Stephen M. Johnson, our Board reevaluated whether the positions of Chairman of the Boardformer President and Chief Executive Officer, should be separate or occupied by the same individual,retired from that position and determinedas a member of our Board of Directors on December 31, 2013. Our Board believes that this is an appropriate structure for McDermott at this time, as it allows Mr. Johnson should serve as Chairman of the Board in addition toDickson, who was appointed President and Chief Executive Officer. As the individual with primary responsibility for managingOfficer on December 16, 2013, to set our strategic direction and manage our day-to-day operations and performance, while Mr. Johnson is most familiar with our business and the complex challenges faced by McDermott. As a result, we believe that he is best positioned at this time to identify strategic priorities and lead Board discussions and decision-making processes regarding key business and strategic issues, as well as to oversee the execution of important strategic initiatives. As Chief Executive Officer, Mr. Johnson is in an optimal position to facilitate the flow of information between management and the Board andMcWilliams is able to ensure that McDermott presents its messageset the Board’s agendas and strategy to stockholders, employees, customers and other stakeholders with a unified voice.

McDermott has adopted a governance structure that includes:

a designated independent Lead Director;

a Board composed entirely of independent directors, with the exception of Mr. Johnson;

annual election of directors; and

committees composed entirely of independent directors.

The independent Lead Director, Mr. McWilliams, acts as an intermediary betweenlead the Board and management and is responsible for presiding at executive sessions of the independent directors and serving as a liaison on Board-wide issues between the independent directors and the Chief Executive Officer, as needed.meetings.

Board’s Role in Risk Oversight

As part of its oversight function, the Board is actively involved in overseeing risk management through our Enterprise Risk Management (“ERM”) program. Our Chief Risk Officer administers our ERM program, and presents to senior management and the Board on matters relating to risk management on at least an annual basis. In connection with the ERM program, the Board exercises its oversight responsibility with respect to key external, strategic, operational and financial risks and discusses the effectiveness of current efforts to mitigate certain focus risks as identified by senior management and the Board through anonymous risk surveys.

Although the Board is ultimately responsible for risk oversight, the Board has delegated risk oversight responsibility to the Audit, Compensation, Finance and Governance Committees for each committee’s areas of oversight, as set forth in their respective charters. Each committee oversees risks, including but not limited to, those set forth below, and periodically reports to the Board on those risks:

the Audit Committee oversees risks with respect to financial reports and other financial information provided by us to our stockholders;

the Compensation Committee oversees risks with respect to our compensation policies and practices with respect to executives and directors as well as employees generally, employee benefit plans and the administration of equity plans;

the Finance Committee oversees risks with respect to our policies and processes relating to capital structure, capital expenditures, financing, mergers and acquisitions and capital expenditures; and

the Governance Committee oversees risks with respect to the review and recommendation of Board member candidates, the annual evaluation of the performance of the Board and its members, review of compensation for our nonemployee directors and director and officer insurance coverage.

At their respective August 2011 meetings, each committee undertook an in-depth assessment of those areas of risk oversight that were delegated to it, and provided a report to the Board. Also, at its August 2011 meeting, the Board received an ERM report from the Chief Risk Officer, and performed an

assessment and review of the risks described in that report that were not delegated to the committees.

Board CommitteesCommittees.

Our Board currently has, and appoints the members of, standing Audit, Compensation, Finance and Governance Committees. Each of those committees is comprised entirely of independent nonemployee directors and has a written charter approved by the Board. The current charter for each standing Board committee is posted on our Web site atwww.mcdermott.comunder “About Us — Leadership & Corporate Governance — Board Committees.” Attendance at committee meetings is open to every director, regardless of whether he/he or she is a member of the committee. The following table shows the current membership, the principal functions and the number of meetings held in 20112013 for each committee:

| Principal Functions and Additional Information | |||

AUDIT

Committee Members: Mr. Trice (Chair) Mr. Hanks Mr. McWilliams Mr. Schumann 4 Meetings Held in 2013 | • • Oversees the integrity of our financial statements. • Monitors our compliance with legal and regulatory financial requirements, including our compliance with the applicable reporting requirements established by the Securities and Exchange Commission (the “SEC”). • Evaluates the independence, qualifications, performance and compensation of our independent registered public accounting firm. • Oversees the performance of our internal audit function. • Oversees certain aspects of our Compliance and Ethics Program relating to financial matters, books and records and accounting and as required by applicable statutes, rules and regulations. • Provides an open avenue of communication among our independent registered public accounting firm, financial and senior management, the internal audit department and the Board.

Our Board has determined that Messrs. Trice, Hanks, McWilliams and |

| ||

COMPENSATION

Ms. Shafer-Malicki (Chair) Mr. Brown

Mr. Trice 10 Meetings Held in 2013 | • Evaluates our officer and director compensation plans, policies and programs and our employee benefit plans. • Approves and/or recommends to the Board for approval such officer and director compensation plans, policies and programs. • Oversees our disclosures relating to compensation plans, policies and programs, including overseeing the preparation of the Compensation Discussion and Analysis included in this proxy statement. • Acts in its sole discretion to retain or terminate any compensation consultant to be used to assist the Compensation Committee in the discharge of its responsibilities. For additional information on the role of compensation consultants, please see “Compensation Discussion and Analysis — Role of Compensation Committee, Compensation Consultant and Management” below. | |||

• For • Under • Under |

| |||

FINANCE

Committee Members: Mr. McWilliams (Chair) Mr. Bookout Mr. Hanks Mr. Luquette Ms. Shafer-Malicki 6 Meetings Held in 2013 | • Reviews and oversees financial policies and strategies, mergers and acquisitions, financings, liabilities, investment performance of our pension plans and our capital structure. • Recommends any change in dividend policies or stock repurchase programs. • Oversees capital expenditures and capital allocation strategies. • Oversees our tax structure and monitors any developments relating to changes in tax legislation. • Generally has responsibility over such matters up to $50 million, and for activities involving amounts over $50 million, reviews |

| ||

GOVERNANCE

Committee Members: Mr. Brown (Chair) Mr. Bookout Mr. 6 Meetings Held in 2013 | • Reviews and assesses the succession plan for the Chief Executive Officer and other members of executive management and reviews such plan with the Board periodically, and at least on an annual basis. • Identifies individuals qualified to become Board members and recommends to the Board each year the director nominees for the next annual meeting of stockholders. • Develops, reviews and recommends to the Board any changes to our Corporate Governance Guidelines the Governance Committee deems • Leads the Board in its annual review of the Board’s performance and, in conjunction with the Compensation Committee, oversees the annual evaluation of our Chief Executive Officer.

• Recommends to the Board the directors to serve on each Board committee. • Recommends to the Board the compensation of nonemployee directors. • Serves as the primary committee overseeing our Compliance and Ethics Program, excluding certain oversight responsibilities assigned to the Audit Committee. • Oversees our director and officer insurance program. | |||

The Board’s Role in Risk Oversight

As part of its oversight function, the Board is actively involved in overseeing risk management through our Enterprise Risk Management (“ERM”) program. Our Chief Risk Officer administers our ERM program and presents to senior management and the Board on matters relating to risk management on at least an annual basis. In connection with the ERM program, the Board exercises its oversight responsibility with respect to key external, strategic, operational and financial risks and discusses the effectiveness of current efforts to mitigate certain focus risks as identified by senior management and the Board through anonymous risk surveys.

Board Committees. Although the Board is ultimately responsible for risk oversight, the Board is assisted in discharging its risk oversight responsibility by the Audit, Compensation, Finance and Governance Committees. Each committee oversees management of risks, including, but not limited to, the areas of risk summarized below, and periodically reports to the Board on those areas of risk:

| Committee | Risk Oversight | |

Audit | • Oversees management of risks related to our financial statements and the financial reporting process | |

Compensation | • Oversees management of risks related to our compensation policies and practices applicable to executives as well as employees generally, employee benefit plans and the administration of equity plans | |

Finance | • Oversees management of risks with respect to our policies and processes regarding capital structure, capital expenditures, financing and mergers and acquisitions | |

Governance | • Oversees management of risks related to the review and recommendation of Board member candidates, the annual evaluation of the performance of the Board and its members, review of compensation for our nonemployee directors, succession planning for the Chief Executive Officer and other members of executive management, our Compliance and Ethics Program (excluding responsibilities assigned to the Audit Committee) and director and officer insurance coverage

| |

| ||

At their respective November 2013 meetings, each committee undertook an in-depth assessment of those areas of risk oversight that were delegated to it and provided a report to the Board. Also, at its November 2013 meeting, the Board received an ERM report from the Chief Risk Officer and performed an assessment and review of the risks described in that report that were not delegated to the committees.

Compensation Policies and Practices and Risk

The Compensation Committee has concluded that risks arising from McDermott’s compensation policies and practices for McDermott employees are not reasonably likely to have a materially adverse effect on McDermott. In reaching this conclusion, the Compensation Committee considered the policies and practices in the following paragraph.

The Compensation Committee regularly reviews the design of our significant compensation programs with the assistance of its compensation consultant. We believe our compensation programs motivate and retain our executive officer employeesofficers while allowing for appropriate levels of business risk through some of the following features:

| • | Reasonable Compensation Programs — Using the elements of total direct compensation, the Compensation Committee seeks to provide compensation opportunities for employees targeted at or near the median compensation of comparable positions in our market. As a result, we believe the total direct compensation of executive officer employees provides a reasonable and appropriate mix of cash and equity, annual and longer-term incentives and performance metrics. |

| • |

|

| • | Clawback Policy — The Compensation Committee has adopted a policy |

| • | Long-Term Incentive Compensation Subject to Forfeiture — The Compensation Committee may terminate any outstanding |

stock award if the recipient, while employed by McDermott or performing services on behalf of McDermott under any consulting agreement: (1) is convicted of a misdemeanor involving fraud, dishonesty or moral turpitude or a felony; or (2) engages in conduct that adversely affects or, in the sole judgment of the Compensation Committee, may reasonably be expected to adversely affect, the business reputation or economic interests of |

| • | Annual Incentive Compensation Subject to Threshold Performance and Linear and Capped Payouts — The Compensation Committee establishes financial performance goals which are generally used to plot a linear payout formula for annual incentive compensation, eliminating payout “cliffs” between the established performance goals. Threshold levels of performance required to earn short-term incentives are tied to |

| • | Use of Multiple |

| • | Stock Ownership Guidelines — Our executive officers and directors are subject to |

|

Compensation Committee Interlocks and Insider Participation

All members of our Compensation Committee are independent in accordance with NYSE listing standards. No member of the Compensation Committee (1) was, during the year ended December 31, 2011,2013, or had previously been, an officer or employee of McDermott or any of its subsidiaries, or (2) had any material interest in a transaction of McDermott or a business relationship with, or any indebtedness to, McDermott. No interlocking relationship existed during the year ended December 31, 20112013 between any member of the Board of Directors or the Compensation Committee and an executive officer of McDermott.

Our Governance Committee has determined that a candidate for election to our Board of Directors must meet specific minimum qualifications. Each candidate should:

have a record of integrity and ethics in his/her personal and professional life;

have a record of professional accomplishment in his/her field;

be prepared to represent the best interests of our stockholders;

not have a material personal, financial or professional interest in any competitor of ours; and